Top 7 Ways AI is Transforming Financial Advisor-Client Relationships

As client expectations evolve, and as the financial landscape becomes more complex, financial advisors are increasingly looking for new, more robust technology to help streamline their workflow. Financial advisors want to free up bandwidth and more fully invest in client relationship development. Leveraging artificial intelligence in the financial services sector, particularly AI-powered tools like Jump, means advisors can deliver personalized, data-driven, and timely communications that meet today’s client needs.

By integrating AI tools into a financial service firm’s tech stack, advisors can spend more time focusing on what matters most: providing strategic guidance and building trust with clients. Here are the top seven ways AI is transforming advisor-client relationships and empowering advisors to elevate the quality of their customer relationships.

#1: Personalized Client Insights with Predictive Analytics

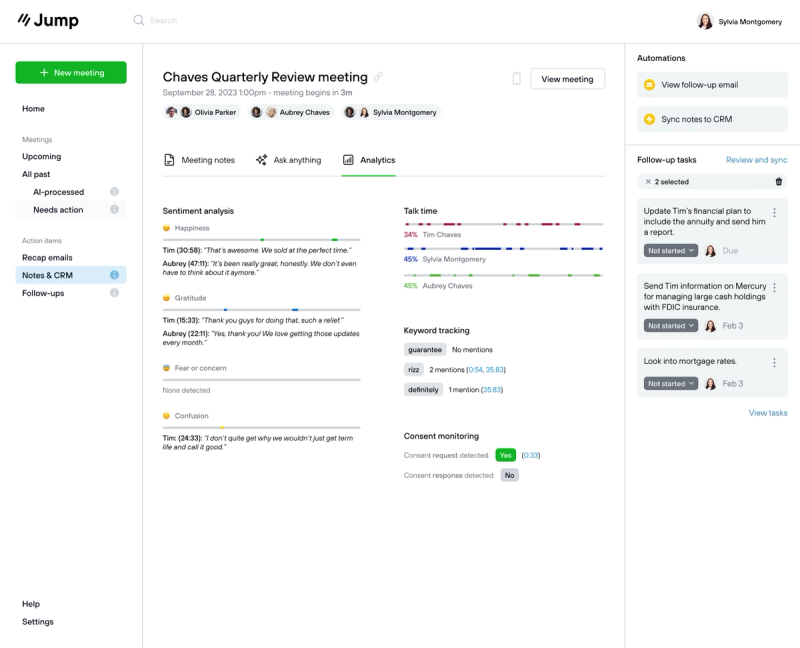

In a world busting at the seams with data, quickly extracting just the right insights for clients from vast amounts of information can be almost impossible. Thanks to predictive analytics in AI, finding the proverbial needle in a haystack for clients is actually possible, helping advisors interpret client behavior patterns and anticipate future needs. Jump’s AI-powered technology, for example, makes it possible for advisors to better identify important inflection points when clients may be ready for new investment opportunities, or when adjustments to their financial plans are needed.

Advisors can proactively reach out to clients with tailored recommendations that align with their goals, demonstrating a deeper understanding of each client’s financial journey.

#2: Seamless Communication Through Conversational AI

Conversational AI in financial services is revolutionizing the way advisors communicate with clients, enabling real-time, data-backed conversations. AI-driven chatbots and virtual assistants can answer routine questions, guide clients through account management, and provide instant responses—even during off-hours.

For example, conversational AI can respond to questions about account balances, recent transactions, or meeting follow-ups. This allows advisors to maintain a steady stream of communication without being overwhelmed by routine inquiries.

#3: Enhanced Risk Management and Compliance

Managing risk and maintaining regulatory compliance are top priorities in the financial industry. AI-powered tools help advisors analyze client portfolios in real-time, identifying areas of potential risk and ensuring alignment with a client’s risk tolerance and financial goals. Predictive risk management enables advisors to adjust strategies based on market fluctuations or changes in client objectives.

Moreover, AI applications in financial services are invaluable for regulatory compliance. AI-driven solutions monitor client interactions, flag potential compliance issues, and automatically generate regulatory reports, reducing the administrative burden while enhancing security and adherence to legal standards. This frees up time for the client and the advisor to discuss things like investment goals, not regulatory compliance or the latest regulations the SEC has started enforcing.

#4: Smarter Portfolio Management Through AI and Machine Learning

AI in finance offers new possibilities for portfolio management, using machine learning to analyze historical trends, market data, and individual preferences to optimize investment strategies.

Generative AI in financial services, for instance, enables complex scenario modeling. Advisors can simulate various economic conditions and forecast potential portfolio outcomes, helping clients visualize the impact of different investment strategies. The conversation now shifts toward painting a picture of the client’s future with visions of their own retirement. This adds depth to financial conversations, allowing advisors to offer clients a forward-thinking perspective on their investments.

#5: Tailored Financial Planning and Real-Time Adjustments

AI-driven technology makes it possible to create tailored financial plans that adjust in real time based on changing client circumstances or market conditions. For example, there are some AI tools that continuously monitor strategies while watching changes in the markets. This makes decision-making faster, but also more informed.

As clients’ needs evolve, AI continually refines these recommendations, allowing advisors to offer proactive guidance that feels personal and relevant.

#6: Elevating Client Experiences with Real-Time Engagement

One of the most impactful benefits of AI in financial services is its ability to open up the advisor’s time to real-time engagement. Jump’s AI-powered tools capture client interactions, preferences, and concerns, giving advisors a comprehensive view of their client’s pain points, needs, and questions. This data is invaluable for anticipating when a client may need additional support, personalized financial advice, or a portfolio review.

Moreover, real-time portfolio monitoring empowers advisors to proactively reach out to clients about significant financial events, such as a market shift or tax-related deadlines. These timely interactions ensure clients feel valued, enhancing their overall experience and fostering long-term loyalty. It paves the way for more trust-building and peace of mind.

#7: Streamlined Document Management and Workflow Automation

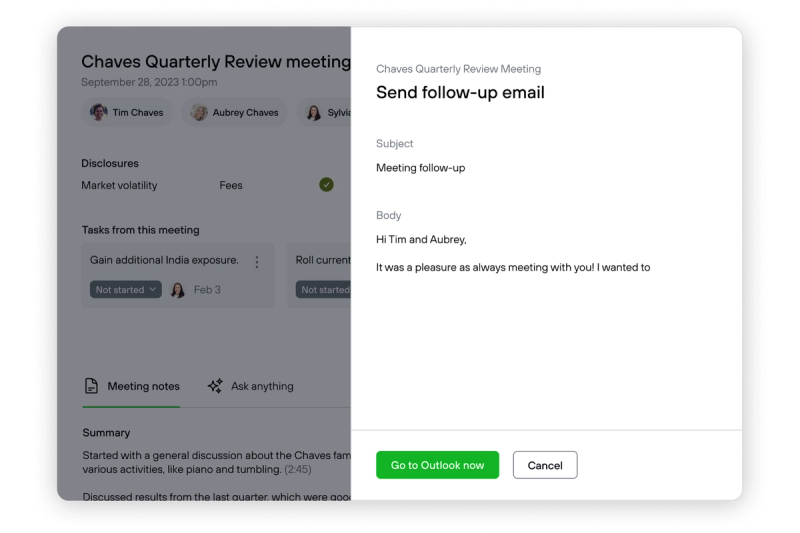

Managing documents and administrative tasks is one of the most time-consuming aspects of financial advising, but AI in financial services simplifies this process. Jump’s AI-driven document management tools handle the categorization, organization, and retrieval of records, allowing advisors to focus on client service rather than paperwork.

In addition to managing documents, AI-driven solutions like Jump automate workflow tasks such as scheduling meetings, tracking follow-ups, and sending reminders. By dramatically reducing time spent on administrative tasks (Jump can eliminate 95% of them), advisors can serve more clients with the same level of personalized care, making it possible to scale their practices efficiently.

Frequently Asked Questions About AI in Financial Services

What is the Role of AI in Financial Services?

The role of AI in financial services is to streamline data analysis, improve customer service, ensure regulatory compliance, enhance risk management, and support strategic decision-making. By automating routine tasks, AI in finance allows advisors to focus on relationship-building and delivering high-quality, data-driven advice. Their clients do not have to navigate the complexities of the financial world, and financial advisors now have more time to focus on the more important tasks of maintaining their relationships and portfolios.

How Does Generative AI Enhance Financial Services?

Generative AI in financial services enables advisors to model different financial scenarios and forecast potential outcomes. This allows advisors to present clients with a range of possibilities, helping them make more informed decisions about their financial strategies.

How Can Financial Advisors Use AI for Better Customer Service?

Financial advisors can use conversational AI, predictive analytics, and workflow automation to enhance customer service. These tools enable real-time engagement, reduce response times, and offer personalized advice, making clients feel more valued and supported.

Will AI Replace Financial Advisors?

AI will not replace financial advisors, but will serve as a type of Ironman suit, a (super) powerful tool to augment their capabilities. Advisors bring empathy, personalized guidance, and trust-building to the table—qualities AI cannot replicate or replace. Instead, AI empowers advisors to serve clients more effectively, creating a partnership that benefits both advisors and clients.

Embracing AI-Driven Solutions with Jump

The positive impact of AI in financial services is undeniable, and tools like Jump are at the forefront of this transformation. Jump’s AI-powered platform streamlines advisor-client interactions, automates workflows, and provides actionable insights that empower advisors to deliver more personalized and proactive service. From predictive analytics to document management, Jump allows financial advisors to stay ahead of client needs and strengthen their relationships at scale.

By adopting AI-driven solutions, financial advisors can transform their practices, enhance client satisfaction, and set a new standard in financial advisory. Ready to see how Jump can take your practice to the next level? Request a personalized demo today and experience the future of financial advisory.

Conclusion

AI is transforming the financial advisory landscape, offering advisors the tools they need to deliver exceptional client experiences, scale their services, and stay competitive in a rapidly evolving industry. With Jump, financial advisors gain an ally in AI that handles routine tasks, predicts client needs, and enables real-time engagement—all while maintaining the human touch that clients value.

As AI in financial services continues to evolve, forward-thinking advisors who leverage these technologies will be well-positioned to thrive, providing clients with the personalized, timely, and data-driven guidance they expect in today’s financial landscape.

About Jump

Jump AI is the leading AI meeting assistant, enabling RIA and Broker Dealer teams to cut meeting admin by 90% while elevating the advisor and client experience. Jump puts meeting prep, note taking, compliance documentation, CRM updates, client recap email, financial data extraction, and follow-up tasks on AI autopilot so advisors can process meetings in 5 min, not 60. Jump is made for advisors, 100% customizable, deeply integrated with the tech stack, and designed with safety and compliance in mind. For more information, visit https://jumpapp.com/.