The Great Wealth Transfer: AI Insights on How Financial Advisors Can Bridge the Generations

In the financial advisor community, it’s no secret: The largest intergenerational wealth shift in history is underway. Over the next two decades, an estimated $124 trillion will be transferred from older generations to heirs and charities in the U.S. alone. This phenomenon, dubbed the “Great Wealth Transfer,” is both a massive opportunity and a looming risk for financial advisors.

Why a risk? Because despite the fact that 84% of heirs say they plan to stay with their parents’ advisor, the fact is that only 30% actually do. This should be a wake-up call to every advisor. And it begs the question: How do you show your value to the next generation in a way that makes staying with you an obvious decision?

To dive deeper into this phenomenon, we used our Jump AI conversational analysis tool to extract insights from the aggregated conversational data of 245,000 meetings, doing a deep dive of 1,991 randomly sampled meetings. We were able to uncover what’s working—and what’s not—when it comes to wealth transfer conversations. The findings reveal that small shifts in how advisors communicate can dramatically improve client commitment and retention.

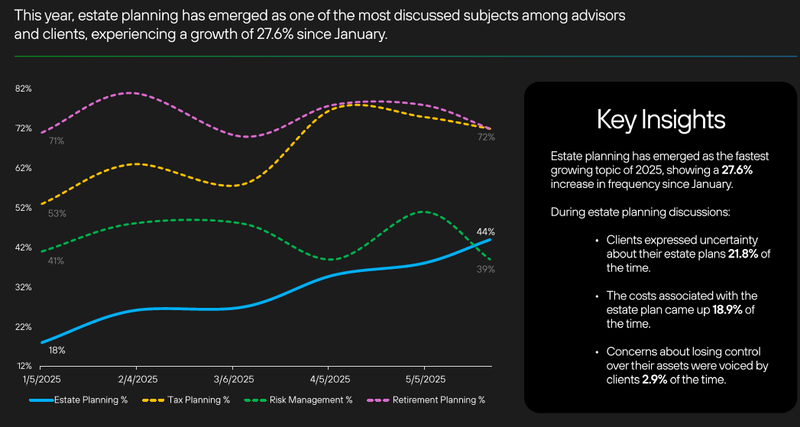

Wealth Transfer Conversations Are on the Rise

The first trend our data tells us is that estate planning and wealth transfer conversations are becoming significantly more frequent in advisor/client conversations.

From January to May, 44% of all advisor-client meetings included a wealth transfer discussion. That’s more than double the 18% from the same period last year. Advisors clearly see the importance of these conversations: both for their clients’ (and their families’) well-being and their business. Advisors understand they need to make a connection to the next generation, and one of the best ways to do this is through estate planning.

Estate planning often offers a natural way to connect to children and other family members, walking them through the estate (with their clients’ permission) in either general or specific terms. It showcases the value the advisor is bringing to the client and the entire family.

Beyond just having the conversations, though, how advisors are approaching the conversations turns out to be very important, according to our conversational analysis.

Advisors Are Driving the Dialogue

In 75% of the wealth transfer conversations we analyzed, the advisor initiated the topic. The truth is, estate planning is something clients often want to avoid or postpone, so it’s not surprising that advisors are taking the lead. And it shows they are bringing a holistic lens to planning.

In 62% of the meetings that broached wealth transfer, though, advisors spoke for more than half the time. While proactive leadership is essential, it’s important not to dominate the conversation. Getting the client’s perspective is key. The best outcomes came when advisors struck a balance between guiding the discussion and giving clients space to reflect and respond.

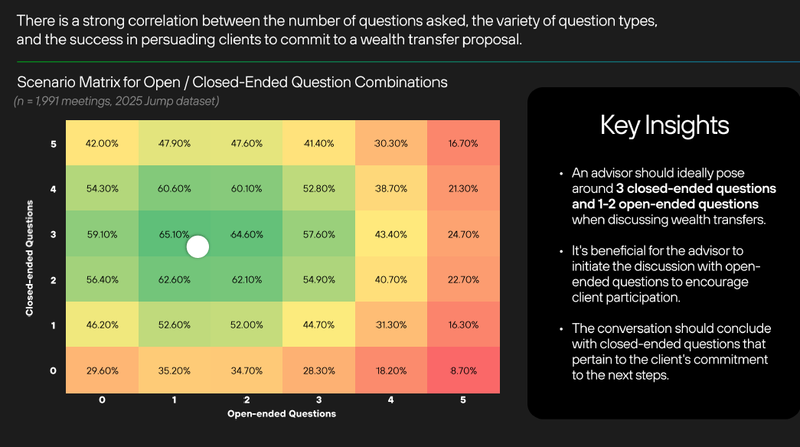

The Power of Strategic Questioning

Here’s something many advisors may not pay too much attention to, but turns out to have an important influence on the wealth transfer conversation: whether an advisor is using open or closed-ended questions as they discuss the topic. It turns out that both are important, for different reasons. Open-ended questions allow the advisor to glean important information about the client’s desires, fears and family nuances, while closed-ended questions aid in getting buy-in to move forward.

Our analysis found that the most effective advisors used a specific mix of questions:

- 3 closed-ended questions

- 1–2 open-ended questions

This combination yielded a 65.1% client commitment rate to wealth transfer recommendations. In contrast, overloading the conversation with too many or overly broad questions led to decision fatigue and lower follow-through. Estate planning can be overwhelming to clients.

Questions to Consider:

- Open-ended:

- What does legacy mean to you?

- You say that a legacy for your heir is important to you. What is your plan to protect that legacy?

- What are your biggest hopes for your family’s future?

- Are there family traditions or values you’d like to see carried forward?

- What concerns do you have about transferring wealth to the next generation?

- What are your top goals you’d like to address with the assets you’ll leave behind?

- How do you envision your children participating in your financial plans?”

- Closed-ended:

- Would you like to schedule a meeting with your family to discuss your estate plan?

- Are you open to exploring gifting strategies this year?

- Have you considered the tax implications of your estate plan?

It’s best to begin with open-ended questions to invite reflection, then use closed-ended ones to drive decisions.

Timing Isn’t Everything, But It Matters

In the conversations we analyzed, client engagement peaked when wealth transfer topics were introduced in the first quarter of the meeting and discussed for 5–15 minutes. This could be due to the fact that bringing the subject up in the beginning of the meeting signifies its importance, or it could simply be a matter of the decision fatigue clients feel at the end of a meeting.

Conversely, bringing up the topic late in the meeting or rushing through it in under 5 minutes—or stretching it beyond 20 minutes—led to a significant drop in client responsiveness. There’s a sweet spot to aim for.

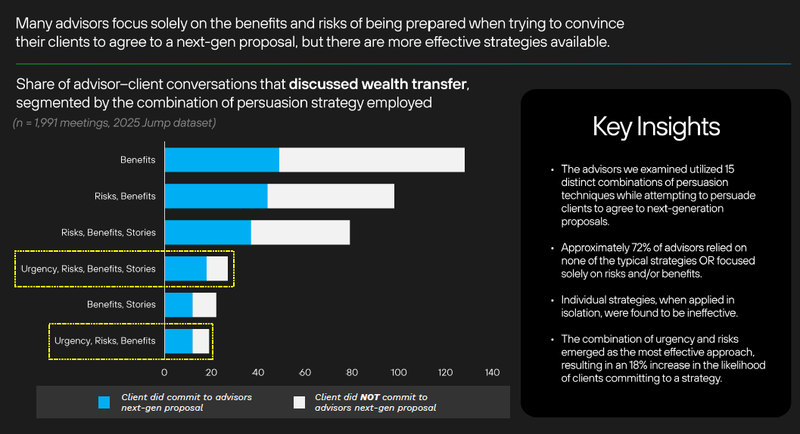

Emotion + Logic = Persuasion that Works

Next, we took a look at persuasion strategy. What tactics and communication techniques are most compelling to this audience when it comes to wealth transfer? After talking with advisors, we decided to dive into the data and test how five common persuasion strategies worked:

Benefits - The advisor highlighted the benefits of being prepared for a wealth transfer.

Risks - The advisor highlighted the risks of being unprepared for a wealth transfer.

Urgency - Did the advisor use urgency when discussing next-generation wealth transfer topics? (e.g., referencing tax-law changes, aging, or time-sensitive estate strategies)

Family Values - Did the advisor appeal to the client's values or emotions during the conversation about next-generation wealth transfer topics? (e.g., protecting loved ones, promoting family unity, teaching financial values)

Social Proof - Did the advisor share stories or examples from other families when discussing next-generation wealth transfer topics? (e.g., success stories about involving heirs, avoiding mistakes, or managing transitions well)

What we found is that it’s not an either/or situation with wealth transfer conversations – the best strategies approached the issue from multiple vantage points.

Advisors who relied solely on either emotional appeals (like urgency or family harmony) or logical arguments (like tax benefits) saw limited success. But those who combined urgency and risk saw an 18% increase in client commitment.

The most effective strategy is layered:

- Urgency (e.g., “Now is the ideal time to act”)

- Risk framing (e.g., “Without a plan, your estate may face significant tax burdens”)

- Tangible benefits (e.g., “A trust can ensure your wishes are honored”)

- Personal stories (e.g., “Let me share how another client successfully navigated this process”)

This blend of emotional resonance and logical clarity proved most compelling.

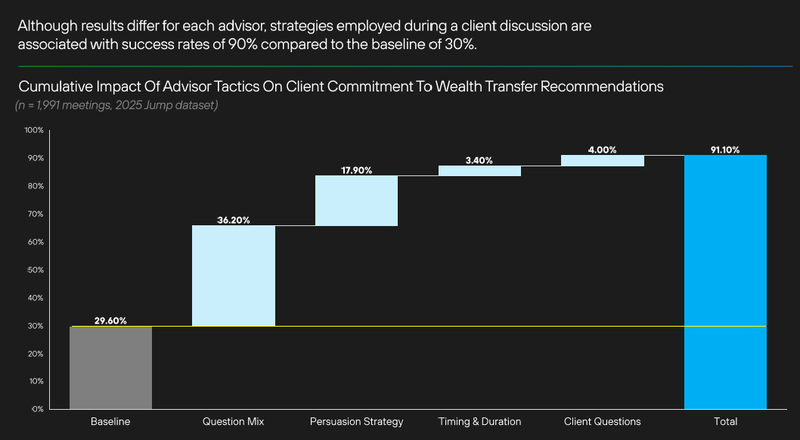

The Compound Effect of Better Communication

By optimizing question strategy, timing, and persuasion techniques, advisors increased client commitment to wealth transfer plans from a baseline of 29.6% to an impressive 91.1%. Although we can’t be sure that these optimized question strategies caused the increase, the correlation is dramatic. The breakdown:

- Question mix: +36.2%

- Persuasion strategy: +17.9%

- Timing & duration: +3.4%

- Client questions: +4.0%

These adjustments may seem like minor tweaks, but they can transform how advisors can build lasting relationships across generations.

Deepening the Advisor and Client Relationship

The Great Wealth Transfer is more than a financial event. It’s a relational one. Advisors who approach it with empathy, clarity, and strategic communication are not only preserving assets but also strengthening family bonds.

Jump AI was designed to help advisors on this journey. With Jump, not only is it easier to prepare for meetings and send personalized communications to clients, you can glean the kinds of insights that will help deepen your relationship with your clients and the next generation.

Not only can advisors on Jump do ad hoc queries to learn more about their clients from past conversations, they can create feedback “scorecards” that allow them to track any number of details on an ongoing basis, so they can set up a scorecard that tracks all of the persuasion techniques discussed above. How often were their questions open versus closed? How long did they discuss estate planning or wealth transfer? What was the ratio of conversation around tangible benefits, risks, and personal stories?

It may be counterintuitive, but AI is allowing advisors to deepen their personal client relationships. The data and analysis it can provide enable advisors to maximize the value they’re bringing clients and their firm, and the efficiencies AI delivers allow advisors to be more present at client meetings while spending less time on admin work. Jump, and the data it provides, is helping advisors work at their peak. They’re better equipped to help clients with their legacies, while also leaving a lasting legacy of their own.

About Liam Hanlon

LIAM HANLON, HEAD OF INSIGHTS

Liam Hanlon is Head of Insights at Jump, the AI Meeting Assistant for Advisors. He leads the team that analyzes over one million advisor-client conversations annually to extract behavioral and predictive insights that drive advisor performance, client outcomes, and firm strategy. Liam translates conversation patterns into actionable intelligence and partners closely with product and design to embed insights directly into the Jump advisor experience.

Prior to Jump, Liam spent seven years at EY in the Wealth and Asset Management Business Consulting practice, where he focused on designing and conducting experiments on financial products and services to improve key business outcomes.