How Jump Saves Advisors Time: Survey Results Are in!

Time is one of the most valuable assets for financial advisors, and Jump is making a measurable difference. According to our recent survey, over 60% of Jump users save more than one hour every single workday.

What does that mean in the long run? For the average workweek, that’s over 5 hours saved. Over a month? 20+ hours back in your schedule. And over a year, advisors could reclaim more than 250 hours—that’s over 6 full workweeks for advisors to focus on what matters most—serving clients and growing their practices.

Here’s a deeper dive into the survey results and what we learned from our users.

Gathering Insights From Advisors Across the U.S.

To better understand how Jump supports advisors today—and how it can be even more helpful in the future—we distributed a survey to a mix of trial users and full subscribers. The survey included both multiple-choice and open-ended questions and was sent to financial advisors using Jump nationwide.

Here’s a quick snapshot of the survey:

- Response period: 12 days

- Participants: Over 100 financial advisors

- Objective: Identify time savings, ease of use, and areas for improvement

Time-Savings That Make an Impact

Survey participants shared how much time they spent on meeting-related administrative tasks (like preparation and follow-up) before and after using Jump.

The results were clear: Jump is helping advisors dramatically reduce their admin workload.

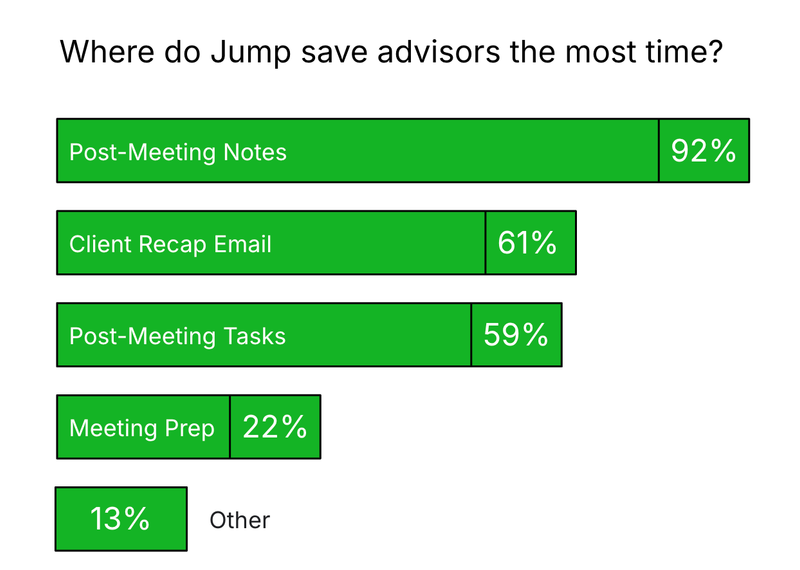

The time-savings Jump feature most users agreed on was post-meeting notes, with over 90% of advisors surveyed saying this feature reduced their workload.

Other features like client recap emails, organizing post-meeting tasks and pre-meeting prep also provided significant time-savings.

One advisor shared that Jump’s integration with his CRM provided time-savings and great value because it automatically added notes to the client’s profile that could be used to deepen client relationships.

What Are Advisors Doing With Extra Time Saved by Jump?

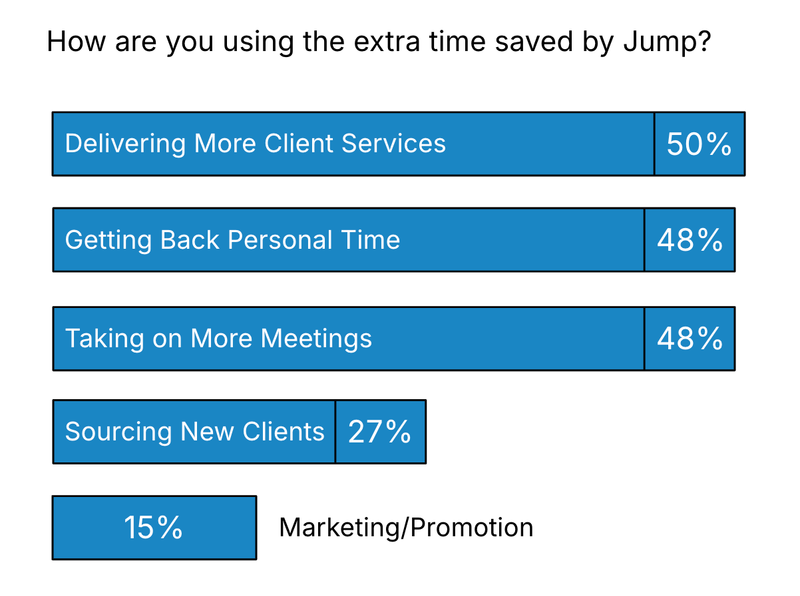

One of the most illuminating questions in our survey asked: “How are you using the extra time saved by Jump?”

- 50% said delivering more services to clients

- 48.1% said getting back personal time (improving work-life balance)

- 27.4% said taking on more client meetings per week

- 27.4% said sourcing new clients

- 15.1% said marketing and promotion

Other responses included

- “I’m finally able to focus on long-term business planning.”

- “Playing catch-up on all the other to-dos!”

- “It’s allowed me to follow through on promises to clients faster.”

- “Better quality meeting summaries improve the client experience with more accurate follow-ups.”

These responses paint a clear picture of how Jump is not only saving time, but also empowering advisors to focus on the areas that matter most. Whether that’s growth, service delivery, or simply creating space for personal priorities.

A Game-changer for Client Experiences

Client experience is at the heart of an advising firm’s success. Beyond financial expertise, clients seek advisors who understand their unique needs, communicate effectively, and build lasting relationships. By focusing on client experience, advisors not only enhance satisfaction but also demonstrate their commitment to helping clients achieve their financial goals.

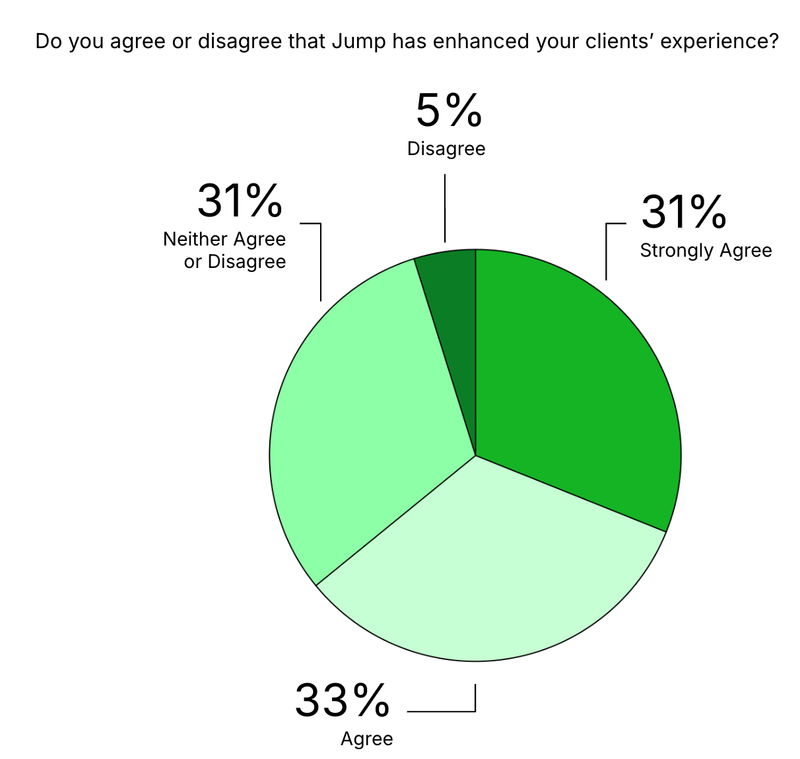

When asked whether or not they agreed Jump has improved the client experience for their own clients, 64% of survey respondents provided positive feedback.

- 31.1% strongly agree

- 33% agree

- 31.1% neutral

Only 4.8% disagree

When we asked users to rate Jump’s ease of use, the feedback was overwhelmingly positive:

- 75% of users rated Jump as "easy" or "very easy" to use.

- 8.8 out of 10 users said they’d recommend Jump to a friend or colleague.

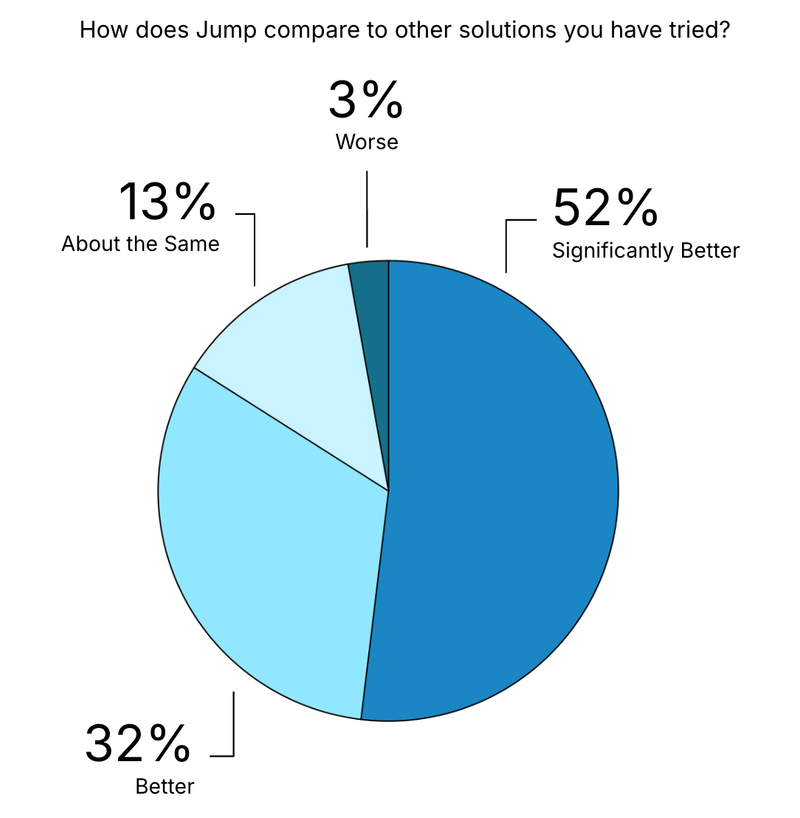

When comparing Jump to other tools for meeting prep and follow-up, 84% of users said Jump is better than other solutions they’ve tried in their financial advising practices.

This overwhelming vote of confidence highlights Jump’s unique ability to streamline meeting workflows while maintaining the personal touch advisors and their clients value. From customizable outputs to seamless integrations, Jump sets a new standard for what financial advisors can expect from AI-powered tools.

About Jump

Jump AI is the leading AI meeting assistant, enabling RIA and Broker Dealer teams to cut meeting admin by 90% while elevating the advisor and client experience. Jump puts meeting prep, note taking, compliance documentation, CRM updates, client recap email, financial data extraction, and follow-up tasks on AI autopilot so advisors can process meetings in 5 min, not 60. Jump is made for advisors, 100% customizable, deeply integrated with the tech stack, and designed with safety and compliance in mind. For more information, visit https://jumpapp.com/.